Bonifii® Digital Trust Registry™

What Are Verifiable Credentials?

Verifiable credentials are digital credentials that can be cryptographically verified, allowing individuals to prove certain attributes or qualifications without revealing unnecessary personal information. These credentials are built on decentralized, blockchain-based systems or other similar technologies that ensure their authenticity and integrity.

Here are some key aspects of verifiable credentials:

What Are Verifiable Credentials?

The world is full of credentials. A credential is a digital assertion containing a set of claims (identity attributes such as name, address, age, gender, etc.) made by an entity about itself or another entity. Passports, drivers’ licenses, insurance cards, and credit cards are all common examples of credentials. But while digital records are nothing new, today’s credentials come with certain “cryptographic superpowers” that make them tamper proof, secure, and verifiable.

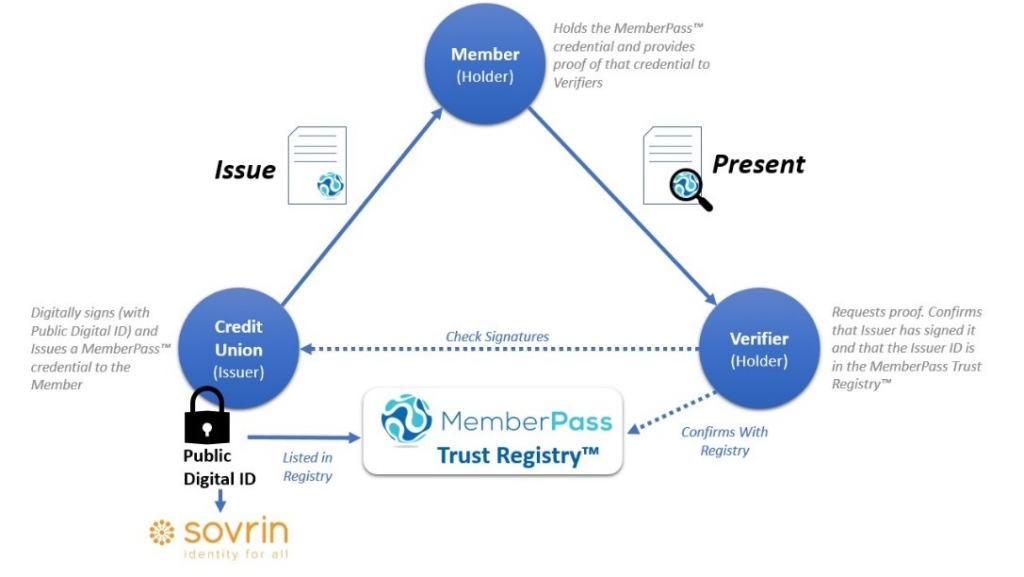

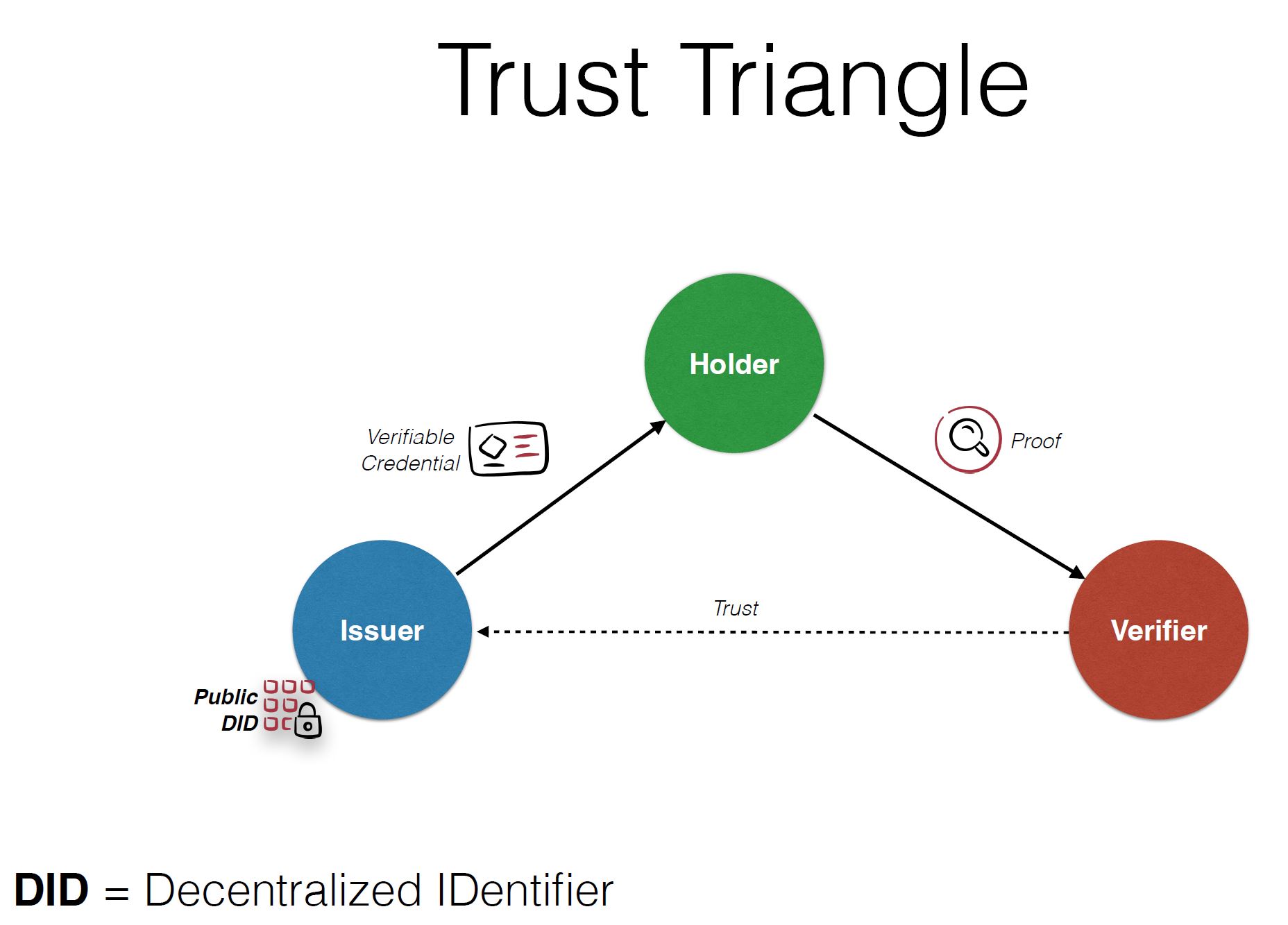

Credential verification is at the heart of the MemberPass Trust Network™, which is where two entities who have MemberPass™ will exchange credentials, information or value on a private, secure peer-to-peer basis. MemberPass™ was built upon internationally accepted digital credential standards, developed and published by the Worldwide Web Consortium (W3C); these standards have been accepted by many industries (not only financial services) for use in developing a verifiable digital credential schema. When digital credentials conform to the W3C’s (www.w3.org) verifiable Credentials Data Model, they are called verifiable credentials. They facilitate interactions using a pattern referred to as the MemberPass™ Trust Triangle.

What Are Verifiable Credentials?

The world is full of credentials. A credential is a digital assertion containing a set of claims (identity attributes such as name, address, age, gender, etc.) made by an entity about itself or another entity. Passports, drivers’ licenses, insurance cards, and credit cards are all common examples of credentials. But while digital records are nothing new, today’s credentials come with certain “cryptographic superpowers” that make them tamper proof, secure, and verifiable.

Credential verification is at the heart of the MemberPass Trust Network™, which is where two entities who have MemberPass™ will exchange credentials, information or value on a private, secure peer-to-peer basis. MemberPass™ was built upon internationally accepted digital credential standards, developed and published by the Worldwide Web Consortium (W3C); these standards have been accepted by many industries (not only financial services) for use in developing a verifiable digital credential schema. When digital credentials conform to the W3C’s (www.w3.org) verifiable Credentials Data Model, they are called verifiable credentials. They facilitate interactions using a pattern referred to as the MemberPass™ Trust Triangle.

The individual or small business member (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The credit union (Issuer) is the source of the member credentials and issues a MemberPass™ to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your credit union or any other organization needs the assurance that the MemberPass credential you are presenting is authentic, validation is provided via the MemberPass Trust Registry™.

The individual or small business member (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The credit union (Issuer) is the source of the member credentials and issues a MemberPass™ to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your credit union or any other organization needs the assurance that the MemberPass credential you are presenting is authentic, validation is provided via the MemberPass Trust Registry™.

Verifiable credentials are stored in a digital format, making them easy to share and verify online.

The credit union (Issuer) is the source of the member credentials and issues a Verifiied® to the member (holder). This is the digital membership pass which third parties can use to verify their members.

Verifiable credentials use decentralized technologies like blockchain to enable third parties to verify their authenticity without relying on a central authority.

They allow for selective disclosure, meaning individuals can choose which credentials to share and with whom, enhancing privacy and security.

Verifiable credentials are designed to be interoperable across different platforms and systems, ensuring compatibility and usability.

Common examples of verifiable credentials include digital diplomas and certificates, professional licenses, vaccination records, and identity documents like passports or driver’s licenses in digital form. They are becoming increasingly important in digital identity management and authentication processes, offering a more secure and efficient way to verify personal information

The individual or small business (Holder) requests verifiable credentials from issuers, holds them in a digital identity wallet and presents proofs of claims from one or more credentials when requested by verifiers (and approved by the holder).

The financial institution (issuer) is the source of the customers credentials and issues a MemberPass® to the customer (holder). This is the digital credential pass which third parties can use to verify their customers.

Any person, organization, or thing (Verifier) requests proofs from holders/provers of one or more claims from one or more verifiable credentials. If the holder agrees, (and the holder always has that choice), the holder’s digital wallet will respond with a proof the verifier can then verify.

When your financial institution or any other organization needs the assurance that the Verifiied credential you are presenting is authentic, validation is provided via the Bonifii Digital Trust Registry™.

Common examples of verifiable credentials include digital diplomas and certificates, professional licenses, vaccination records, and identity documents like passports or driver’s licenses in digital form. They are becoming increasingly important in digital identity management and authentication processes, offering a more secure and efficient way to verify personal information

How Does The Digital Trust Registry™ Work?

How Does The MemberPass Trust Registry™ Work?

How Does The MemberPass Trust Registry™ Work?

When you join the Digital Trust Registry™, your financial institution credit union’s Public Decentralized Identifier (DID) is written to the blockchain network and listed in the registry.

This means that:

- When you are ready to the Verifiied credentials to your customers, you can start right away.

- Other network participants will know you are registered as an issuer in the Bonifii Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your customer’s credentials, they want to know two key things:

- That your institution signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

That your Public DID is listed in the Bonifii Digital Trust Registry™. This lets them know that the credential came from a verified issuer.

When you join the MemberPass Trust Registry™, your credit union’s Public Decentralized Identifier (DID) is written to the Sovrin Global Identity Network and listed in the registry.

This means that:

- When you are ready to issue MemberPass™ credentials to your members, you can start right away.

- Other network participants will know you are registered as an Issuing credit union in the MemberPass Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your member’s MemberPass credentials, they want to know two key things:

- That your credit union signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

- That your Public DID is listed in the MemberPass Trust Registry™. This lets them know that the credential came from a bona fide credit union.

When you join the MemberPass Trust Registry™, your credit union’s Public Decentralized Identifier (DID) is written to the Sovrin Global Identity Network and listed in the registry.

This means that:

- When you are ready to issue MemberPass™ credentials to your members, you can start right away.

- Other network participants will know you are registered as an Issuing credit union in the MemberPass Trust Network™. No spoofing can ever take place since your credit union will be an authenticated participant in the network.

When other institutions receive one of your member’s MemberPass credentials, they want to know two key things:

- That your credit union signed it cryptographically with your Public DID. This lets them know that the member data hasn’t changed.

- That your Public DID is listed in the MemberPass Trust Registry™. This lets them know that the credential came from a bona fide credit union.

Participants

As the Bonifii Trust Network™ grows, participants will look for financial industry leaders that are building out services that they can use in their digital lives.

Financial Institutions

Leading financial institutions are building out the Bonifii Trust Network™.

How can my financial institution get started?

- STEP 1 – Join the Bonifii Trust Registry™ and establish your Public Decentralized Identifier (DID) designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin using Bonifii’s services

Developers

Developers using the Bonifii API (aka CULedger.Identity) are already using the Bonifii Trust Registry™. As the Bonifii Trust Network™ grows, the registry will be made public to developers that are integrating Bonifii’s services into their systems.

Members

As the MemberPass Trust Network™ grows, members will look for the credit union leaders that are building out services that they can use in their digital lives.

Credit Unions

Leading credit unions are building out the MemberPass Trust Network™. Initially they are using MemberPass™ in their own credit unions with members and employees. They also know that the value of MemberPass™ grows as more organizations become issuers and verifiers in the network.

How can my credit union get started?

- STEP 1 – Join the MemberPass Trust RegistryTM and establish your place on the Sovrin Global Identity Network, which is a distributed ledger or blockchain designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin issuing MemberPassTM.

Developers

Developers using the MemberPass API (aka CULedger.Identity) are already using the MemberPass Trust Registry™. As the MemberPass Trust Network™ grows, the registry will be made public to developers that are integrating MemberPass™ into their systems.

Members

As the MemberPass Trust Network™ grows, members will look for the credit union leaders that are building out services that they can use in their digital lives.

Credit Unions

Leading credit unions are building out the MemberPass Trust Network™. Initially they are using MemberPass™ in their own credit unions with members and employees. They also know that the value of MemberPass™ grows as more organizations become issuers and verifiers in the network.

How can my credit union get started?

- STEP 1 – Join the MemberPass Trust RegistryTM and establish your place on the Sovrin Global Identity Network, which is a distributed ledger or blockchain designed exclusively to support digital trust networks and verifiable digital credentials.

- STEP 2 – Begin issuing MemberPassTM.

Developers

Developers using the MemberPass API (aka CULedger.Identity) are already using the MemberPass Trust Registry™. As the MemberPass Trust Network™ grows, the registry will be made public to developers that are integrating MemberPass™ into their systems.

Get More Information Now!

Get More Information, Schedule a Demo, or Stay in Touch