Given the vast percentage of online financial interactions members have with their credit union, it’d be a good time to have a reliable digital authentication solution. If only you could ask for a physical ID in a digital setting, right?

If only.

On top of it, most people are alarmed by the increase in digital identity thefts and data breaches. These events directly expose sensitive personal information to hackers.

Digital identity proof is the solution to online authentication

That’s pretty obvious. Digital identity is used widely today for online access to healthcare, financial services, restaurants, and retail. Currently, it comes three types, which function and behave differently.

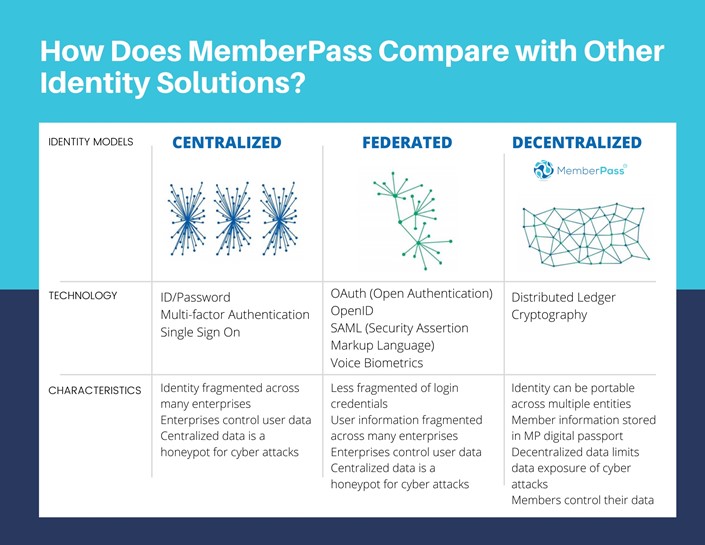

Siloed and centralized identity

Traditional, “siloed” identity is the simplest of the three. In this model, an organization issues (or allows you to create) a digital credential in order access its services.

The trust relationship is established through the use of shared secrets. These are usually things like a username and password, along with additional private information, such as your birthday, mother’s maiden name, a PIN and so on.

The siloed identity model delivers the worst customer experience of the three models. The tedious set-up-a-username-and-password-plus-more scenario repeats for every app or website your member logs into.

As a result, your member has to create and manage usernames and passwords for each relationship. According to some estimates, this means most people can easily accumulate 100 or more of these username/password combinations to manage and remember.

Plus, the silo organizations own the member data and store it in massive central databases. This elevates the risk for data breach and fraud. The vast databases are extremely tempting targets for hackers.

Federated or user-centric identity

The federated or identity provider model adds a third party to act as an “identity provider” (IDP) between the member and a website. The IDP issues the digital credential and provides a single sign-on experience which is portable and can be used in other situations. This reduces the number of username/password combinations a member needs to keep track of.

When the member logs into the IDP, it “federates” the login to the website the member wants to access. Trust between the member and the IDP is established in the same manner as in siloed identity. It’s typically through username and password and may be fortified with additional verification factors.

The most common example of a user-centric/federated digital identity is a social login on the web via Facebook, Google, Twitter or other social media site. Before a member logs into an application, the IDP requests your consent before it allows the application to access your data.

Importantly, IDPs also have access to sensitive personal member data. And, they have the right to sell this personal information because they own it. Do you think your members would be happy if they knew someone else had absolute ownership of their personal data?

Self-sovereign or decentralized identity

This is the best and most privacy-preserving digital identity model. It’s also the most appropriate fit for all types of financial services.

A self-sovereign identity allows your members to retain full control of their identity. It adds security and flexibility because it allows the member to reveal only the data necessary for a given transaction. It eliminates the need for either siloed or federated identities, and best of all, it’s almost impossible to hack or steal.

The cryptographically protected digitally signed self-sovereign credentials verify four things:

- Who issued it (credit union)

- Who owns it (the member)

- Whether it’s been altered after it was issued

- Whether it’s been revoked (by the issuer)

It effectively gives members a direct, encrypted digital connection to the credit union. No third party comes between you and your member. And, no one but the member owns his or her personal data!

How to begin your search for a digital identity solution

When it’s time to research digital identity solutions to find the one that’s best for your credit union, ask yourself these questions about every one you consider:

- Does it reduce dependence on obsolete security questions in the call center?

- Does it ensure trusted two-way communication to help eliminate fraud, impersonation, and identity theft?

- Can it create a satisfactory omni-channel authentication experience?

- Does it address member data privacy and allow them to own their personal information?

- Is it portable and interoperable so it’s useful outside the credit union system?

- Does it offer protection against being hacked or corrupted?

- Does it comply with consumer data privacy laws?

- Does it offer a long-term solution to reduce the expense of fraud and other financial scams?

The demand for digital identity won’t go away

If you don’t already have a digital ID solution at your credit union, we suggest you learn more about MemberPass.

Your members will thank you when you help them appreciate the direct and immediate benefits of MemberPass digital ID. It’s fast, secure, virtually unhackable, and immune to identity theft. Plus, each member owns and controls their personal information.

To request a MemberPass demo, email us to set one up. You can also register to attend a webinar or simply visit us online at www.memberpass.com to find out more.

The sooner you get started, the sooner your members can enjoy the benefits!

Bonifii, a credit union service organization, offers MemberPass, a simple, secure and convenient member identity verification method. MemberPass is a digital passport that provides members convenient access to their financial accounts while allowing control and privacy over their personal information. We leverage touchless technology to protect you and your members. Visit www.memberpass.com or email sales@memberpass.com.